how it works

Costs

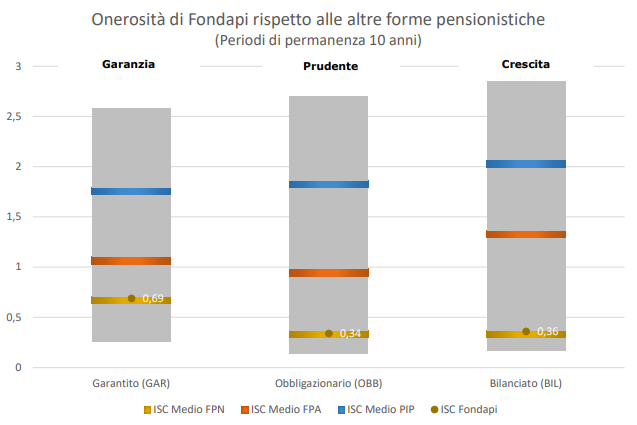

When it comes to choosing an investment source, costs naturally represent a fundamental component of an individual’s decision-making process.

Precisely because transparency is one of Fondapi’s core values, we offer a tool that allows direct comparison between the various available options.

Before comparing the costs of pension funds, it is useful to distinguish between the various types of costs that a member may encounter when subscribing to a supplementary pension plan.

Different types of funds, different costs

Among the different types of pension funds available in Italy, there are significant cost differences. Generally, the less expensive funds are the negotiated ones, which are provided for by the national collective labor agreement (CCNL) and whose membership is tied to it. The low costs are due to the fund’s legal nature. These are organizations that, by their internal statute, do not need to generate profits (non-profit) and rely on the support of local union structures for promotion.

Two types of pension fund costs can be identified:

- Costs directly borne by the member:

charges that cover administrative activities. Often, this is a fixed annual fee (membership fee). Other times, it is a percentage deduction from contributions. - Costs indirectly borne by the member:

these are charges that cover the activities of financial managers and the custodian bank. They are borne by the Fund’s assets and then distributed to each individual member. - Performance costs:

these are always borne by the member but are only applied when the member initiates a transaction (a compartment change, an advance, and similar).

There are costs and costs

Understanding and effectively comparing how much a pension fund costs is not a simple task. To assist those interested, the

The ISC indicates the percentage impact of costs on the accrued individual position during the accumulation phase.

The same supervisory authority has estimated that an ISC of 2% instead of 1% can reduce the accumulated capital after 35 years by about 18%, for example, reducing it from 100,000 to 82,000 euros.

Fonte: Covip

Fondapi has a cost of €22/year (membership fee). At the time of joining, and only at that time, the member and the company share the membership expenses, amounting to €11.36 each.