A supplementary pension is a form of retirement savings. In addition to the INPS pension (the first pillar), it provides a second source of income once you reach retirement age and, therefore, represents the second pillar of the Italian pension system.

Due to the gradual reduction of the INPS pension allowance, its goal is to help maintain an adequate standard of living even after retirement. Thanks to its social role, savings grow within a protected framework and benefit from tax advantages.

How supplementary pension and the need for a supplementary pension came about

From the earnings-related system to the contribution-based system.

The Italian public pension system is based on a pay-as-you-go model. This means that today’s pensions are paid by workers currently in employment; their pensions will, in turn, be funded by future workers. This is the so-called “intergenerational pact”, in place since the 1970s.

The Italian demographic trend — marked by a continuous decline in birth rates and an increase in average age — has reduced the number of workers while increasing the number of people entitled to a pension. Inevitably, this has created a significant deficit in the State’s budget, forcing the country to take on debt to cover pension payments.

Over the years, numerous pension reforms have been introduced to ensure the long-term sustainability of the system. At the same time, however, these reforms have progressively reduced the pension benefits that future retirees can expect. The shift to a contribution-based model — which tends to lower the final pension amount — is the direct result of these changes.

Supplementary pension schemes were therefore designed as a support to the mandatory public pension system. They are voluntary, fully funded schemes that allow individuals to build an additional pension, with the goal of ensuring a more adequate standard of living in retirement.

The legislator has also made it possible to access the accumulated funds to meet specific needs that may arise over a person’s working life or during retirement. For example, members may request advances when certain conditions occur, or withdraw part or all of the accrued savings under specific circumstances.

How

the supplementary pension is structured

Pension funds operate in financial markets using a “capitalization” method: employers and employees make regular contributions, which are invested according to the investment line (sub-fund) chosen by the member.

When the member reaches pension eligibility, the accumulated capital (the sum of contributions plus investment returns) is paid out as a supplementary pension benefit. This benefit can be paid in a lump sum or in periodic installments (in this case, as an annuity).

Types of pension funds

The pension fund, as the name suggests, is the tool designed and created to build a supplementary pension.

In Italy, there are three different types of pension funds: here’s what they are and how to choose the one that best suits your needs.

Negotiated (or closed) pension funds

Fondapi belongs to this category. Membership in these funds is reserved exclusively for specific categories of workers and stems from agreements between trade associations and worker representatives.

Open pension funds

As the name suggests, membership in this type of fund is open to anyone who intends to build a supplementary pension, regardless of the category specified in their employment contract. These funds are mainly established by banks and insurance companies.

PIPs (Individual Pension Plans)

These are intended for anyone who, regardless of their employment situation, wants to build a supplementary pension. They are established solely by insurance companies.

The difference between these types of funds is mainly related to their cost; negotiated pension funds (linked to the CCNL) generally have lower costs than the other two types: this is because, by statute, they are non-profit organizations, meaning they do not have to generate profits or remunerate shareholders.

At the same time, the costs connected with promoting the Fund are minimal, and the parties involved in its promotion at local level are the trade unions.

Finally, the last major difference concerns the composition of the Board of Directors (BoD): in category-based funds, it is made up equally of worker representatives (CGIL, CISL, and UIL) and employer representatives (CONFAPI in the case of Fondapi).

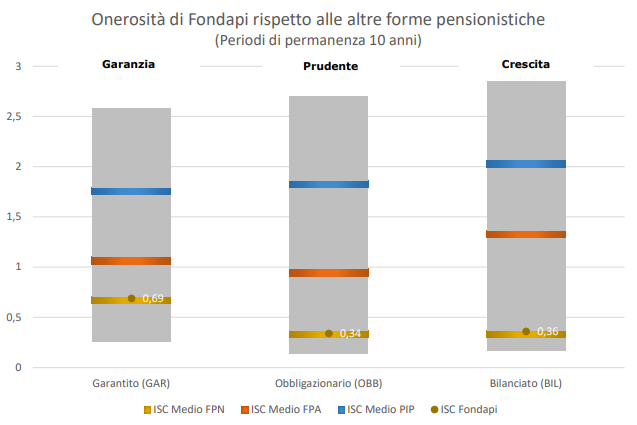

The image shows the average Synthetic Cost Index (SCI) of the various supplementary pension plans. The supervisory authority has estimated that an SCI of 2%, instead of 1%, can reduce the accumulated capital after 35 years by roughly 18%. For example, this would lower it from €100,000 to €82,000.

Fondapi’s SCI, compared with the average cost of other closed funds, open funds, and PIPs. The image provides a full overview of all Fondapi costs. Further details on operating or service costs can be found in the “Costs” Sheet.

The benefits of joining supplementary pension

For a complete list of benefits related to supplementary pension savings, we invite you to visit the advantages page, available here!

Deductibility

Tax deductibility of contributions paid into supplementary pension plans up to €5,164.57 per year.

Taxation

IRPEF taxation of TFR and contributions paid to the pension fund is applied at a favorable rate, up to a maximum of 23% for redemptions before retirement, and between 15% and 9% (depending on years of membership) for payments made after retirement.

Company contribution

Company contribution: this consists of an additional payment made entirely at the company’s expense.

This payment is the worker’s right only when joining negotiated funds, while in all other cases the contribution is deducted from the employee’s paycheck at their own expense.

Advances

Possibility of requesting advances or partial or total redemptions when certain specific conditions occur.

Investments and financial management

At the time of joining, the worker is free to choose the investment compartment that best fits their personal profile.

Fondapi’s management, oriented towards a sustainable investment policy, provides three lines.

Growth

A balanced compartment in which equity and bond securities have the same weight.

Guarantee

A compartment composed of 90% bond securities, with an insurance guarantee that, in the event of negative returns, allows you to obtain an amount at least equal to what you paid in.

Apart from risk propensity, which varies from person to person, the theory behind compartment choice is based on the investment time horizon: the longer the time horizon, the more advisable it is, during the accumulation phase, to choose compartments with a higher equity component, and then gradually shift towards compartments with fewer equities as retirement approaches.

For more information on investment compartments and obtainable returns, read the in-depth analysis available by clicking here.

The payout: two types of supplementary pension

Before talking about supplementary pension, it is necessary to distinguish between:

Capital benefits

These are lump-sum payments made by the pension fund that are paid out with a single disbursement, without any fractioning over time. This includes advances, redemptions, and many retirement payouts, which Fondapi usually disburses within about 70–80 days.

Annuity benefits

These are the supplementary pensions, i.e., periodic payouts made to those who have joined Fondapi. This includes certain retirement payments that are paid for the entire lifetime of the worker and the RITA (Anticipated Temporary Supplementary Income): an annuity that can be requested by workers close to retirement but who are out of work, and which stops being paid once pension eligibility requirements are met.

The supplementary pension can consist of an annuity benefit that is paid periodically to the retiree as long as they are alive, which is the same exact thing that happens with the basic pension (for example, from INPS).

Is the supplementary pension in annuity form always mandatory?

The answer is no. The annuity is mandatory only for those who have accrued higher contribution positions. You need to compare.

One must compare the accrued pension savings with the amounts reported in the threshold values table, available by clicking here. These amounts differ based on:

- the member’s gender;

- the age of the member requesting the annuity;

- the value of the social allowance, which is recalculated annually.

As a result, the threshold values are recalculated every year and may undergo negligible variations.

Specifically: if the amount accrued is lower than the threshold, the retiree is free to receive the full amount as a lump sum, with no installments (capital benefit, no annuity). If the amount accrued is higher than the threshold, the retiree is required to convert at least half into an annuity, which then becomes a supplementary pension.

Fondapi does not only pay out supplementary pensions; there are also many other benefits, including:

- advances for healthcare expenses, or for the purchase or renovation of a first home, and for other needs that do not require justification;

- total and partial redemptions, for example following resignation or dismissal;

- retirement lump-sum payments

.

Customize the installments and frequency of your supplementary pension

When the right to the pension matures, the member who chooses or is required to request the annuity must choose:

- the frequency of annuity payments — that is, how often they wish to receive the supplementary pension;

- the annuity most suitable for their needs among the six different types offered by Fondapi, each with different conditions and guarantees.

By clicking here you can view the different types of annuities, the payout frequencies and some annuity examples.

To make some projections of your income at retirement age, you can use the two tools shown below:

Pension simulator

The pension simulator, which helps to make a projection of the basic pension and the coverage of the supplementary pension.

Annuity calculation engine

The annuity calculation engine to quantify the amount of the supplementary pension based on the different types of annuity.

The protections for members

The amount paid and accumulated in the pension fund is strongly protected. In particular, the resources paid in are non-pledgeable, non-seizable, cannot be assigned, and cannot be claimed even in the event of closure or bankruptcy of the pension fund; in such a case, members’ positions are either liquidated or transferred to another pension fund.

Another important protection is that, in the event of death before receiving the supplementary pension, the amount accumulated at that time is transferred to the heirs or any other designated beneficiaries, without any inheritance tax.

Is retirement approaching?

If you are less than six months away from retirement and would like to be contacted by Fondapi for a personalized consultation, send an email to pensione@fondapi.it including your name and a telephone number: we will contact you as soon as possible

Or, click the button below and discover all the ways to get in touch with us!